Menu

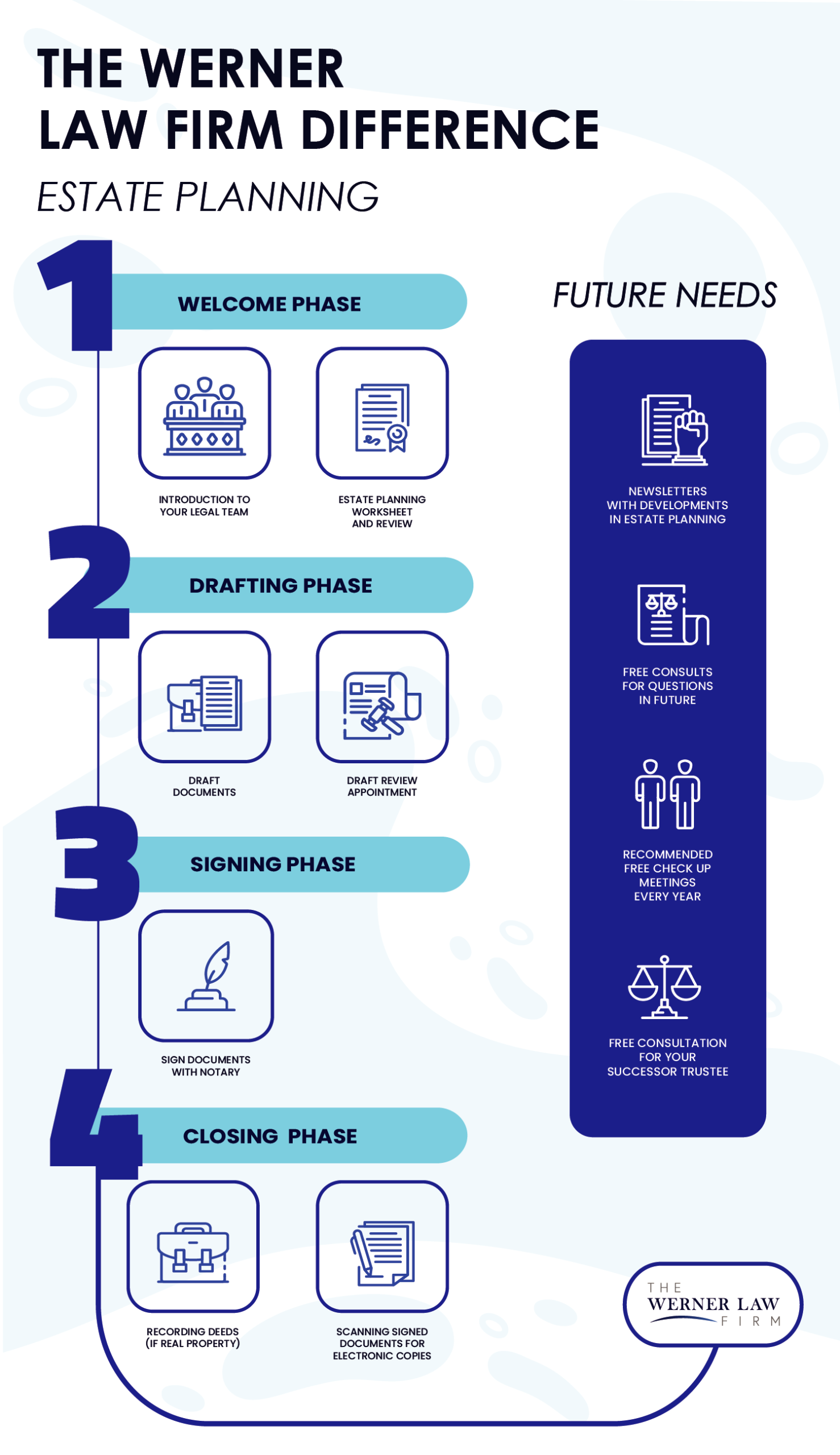

At The Werner Law Firm, our living trust attorneys can help you to navigate the waters toward creating a living trust to protect your assets. After creating a living trust, you can:

To sell property owned by a trust, you can simply sign documents as trustee of the trust. As long as you are the trustee, you will maintain control over any and all property owned by the trust – and can determine who will succeed you as trustee. In this way, a trust allows you to retain control of your property and effectively distribute your assets to your inheritors.

Our estate planning professionals will explain the legal process in creating these documents, determine what would be most beneficial to you, and figure out a game plan moving forward. Call us today to book a free appointment and for information on hiring us as your trusted living trust attorney.

23 Corporate Plaza Dr., Suite 150

Newport Beach, California 92660