Menu

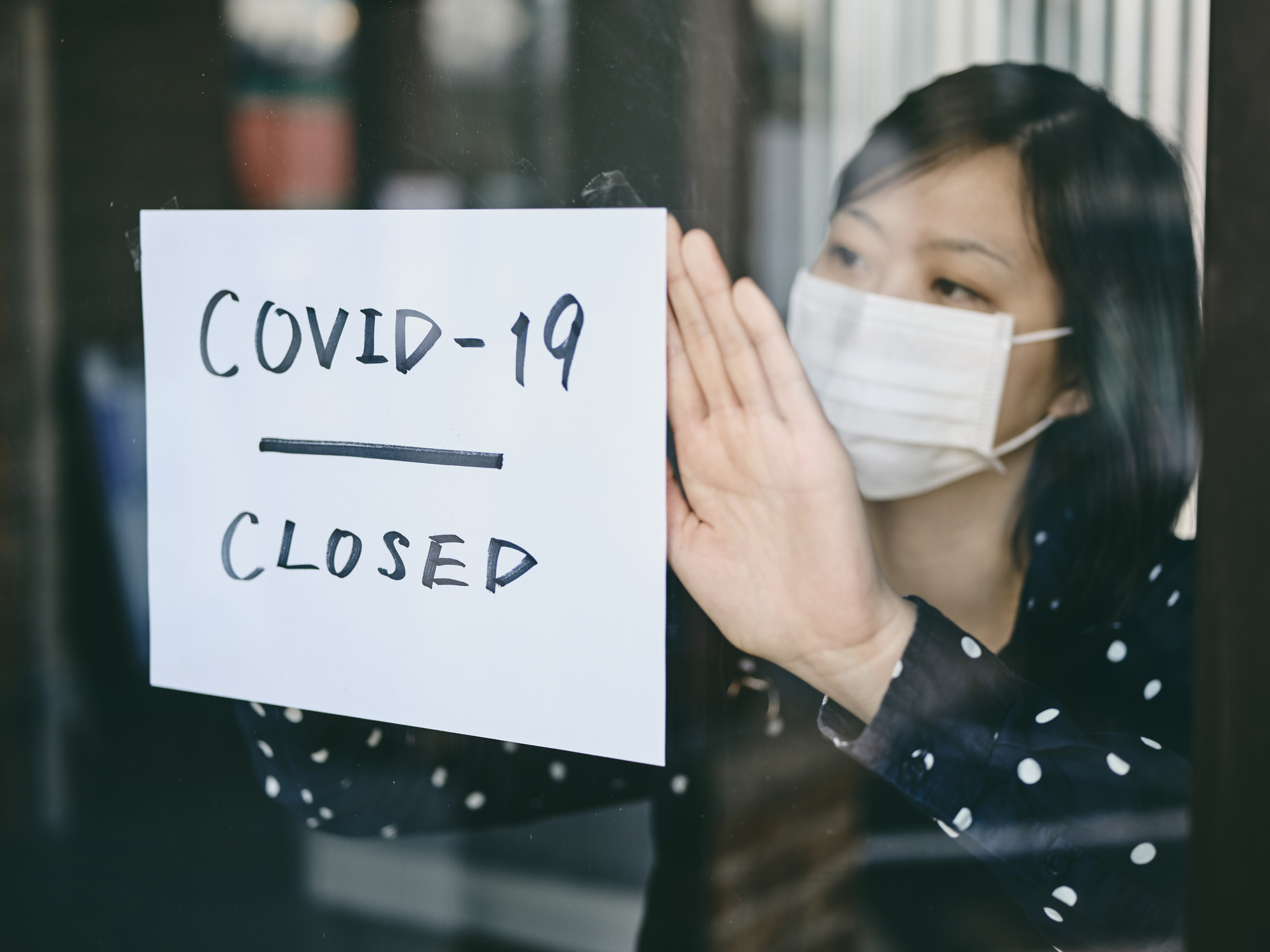

COVID-19's impact on the economy has been absolutely devastating. Not only have lockdowns and travel restrictions greatly impacted industries across the country, but for every death, there is an assorted collection of infections with short-term and long-term physical deficits, grieving parents and children, and countless Americans laid off as business owners line-up to file bankruptcy.

This paints an incredibly grim picture of the US economy, and the total economic impact of the coronavirus. Some businesses have been able to successfully pivot and survive through modest savings and an immediate switch towards catering to their customers via delivery services, contact-less pickup, and other alternative solutions that minimize exposure.

Other businesses that rely entirely on close physical contact – from spas to gyms – have had little option but to shutter, or limit operations to less profitable long-distance classes and instructional videos. For those who have had to experience mounting debt as a result of COVID-19, one of the silver linings is that it has led the government to amend bankruptcy options for small businesses.

As a result, many entrepreneurs and smaller ventures have been able to repay and get rid of their debts in a way that might help them survive the crisis, and get back in the black.

–

The bankruptcy process sounds horrendous, but it is meant to provide an out in situations where an individual or business’ debt has become so unmanageable that they have no other choice.

When a company itself is not worth enough to cover the entirety of a debt, or when a company’s revenue or a person’s income cannot possibly cover what is owed, they can choose to file for bankruptcy under a number of different ways, via the Bankruptcy Code.

In most cases, the bankruptcy process begins with a petition for bankruptcy. Once you go to the local courthouse to file for bankruptcy, you will be asked to present a bankruptcy plan. Bankruptcy plans for small businesses usually follow three basic outlined paths:

Also known as a liquidation bankruptcy, the Chapter 7 bankruptcy option will require you to sell most of what isn’t exempt by law in order to cover a portion of the debt before it is absolved.

Generally used by individuals, Chapter 13 bankruptcy can allow a business to continue operating while repaying a portion of the debt over three to five years.

Under the Chapter 11 bankruptcy option, your business will be allowed to continue under the purview of an appointed trustee, until you have paid off a portion of the debts.

–

Among the three options available to small businesses, the most common are Chapter 13 and Chapter 7. This is because a Chapter 11 bankruptcy process can be very difficult for a business in dire straits to manage, particularly if they don’t feel that there’s a windfall coming any time soon.

Chapter 11 bankruptcies usually require hefty filing fees and administrative costs, as an appointed trustee will help make sure that you are sticking to the plan. In most cases where a business may have the capacity to repay some portion of the debt, business owners may consider filing for a Chapter 13 bankruptcy.

In cases where their best option is to dissolve the business, they may consider filing for a Chapter 7 bankruptcy. However, given the extreme circumstances thousands of small business owners are facing today, congress has made changes to the Bankruptcy Code via two important acts that may help small businesses restructure and stay alive during this crisis.

–

In February 2020, the Small Business Reorganization Act of 2019 (SBRA) added a subchapter V to Chapter 11 of the Bankruptcy Code. Under this new subchapter:

Any businesses with a total debt of less than $2,725,625 would be eligible for a streamlined and simplified bankruptcy process that would allow them to set up a new repayment plan through the courts that creditors must accept, often giving small businesses with debt within the threshold a more favorable way to restructure outside of selling off all assets (as in Chapter 7 bankruptcies), or going through a lengthy and painful restructuring process (as in Chapter 13 bankruptcies).

In April, the Coronavirus Aid, Relief, and Economic Security (CARES) Act further expanded the eligibility for businesses seeking to file bankruptcy under subchapter V of Chapter 11 of the Bankruptcy Code by raising the debt limit to $7.5 million. For now, the Act has raised this limit for the entirety of 2020 – but some believe Congress might make it a permanent part of the subchapter V in time. The other eligibility requirements are quite simple, and include:

This new option contrasts with regular Chapter 11 bankruptcies as it allows smaller businesses to do away with the upfront administrative costs associated with filing for chapter 11 bankruptcy. Much like any other bankruptcy process, filing for a subchapter V requires filing for a petition for bankruptcy and scheduling a meeting with creditors to discuss favorable terms.

Once the court approves your bankruptcy plan, you can continue to operate while paying off the portion of the debt agreed upon in the plan. Given the hefty monkey wrench that the coronavirus has thrown into the US economy, small businesses are likely to struggle to find ways to stay afloat and pay for their expenses.

They bear the brunt of the burden, closing down at a more rapid rate than at any point in recent history. We are faced with an economic catastrophe mirroring the crisis of 2008, and many business owners are struggling to find hope.

The option to restructure, file for bankruptcy, wait it out and rebuild after most of the crisis has passed represents a small light at the end of the tunnel - a way out of mounting debt, and a path toward a future where an aspiring business owner may be able to continue providing for their loved ones in spite of recent hardships.

If you need legal advice and help regarding small business bankruptcy or wish to learn more about the bankruptcy process, do not hesitate to contact an experienced bankruptcy lawyer. This is not something you should go through alone.

Founded in 1975 by L. Rob Werner and serving California for over 50 Years, our dedicated attorneys are available for clients, friends, and family members to receive the legal help they need and deserve. You can trust in our experience and reputation to help navigate you through your unique legal matters.

Whether you need help creating a living trust or navigating probate, our living trust law firm's compassionate team of estate planning lawyers and probate lawyers are here to help you and ready to answer your questions.

Our goal is to make your case as easy as possible for you. Hiring a lawyer can be a daunting task, but it doesn’t have to be. From the moment you contact our firm, through the final resolution of your case, our goal is to make the process easy and understandable. We cannot change the fact that probate is a long and complicated process, but through our Werner Law Firm Difference, we strive to go out of our way to keep you informed of your case through every step of the way. We are constantly refining our processes and procedures for a more streamlined and calm client experience. Our goal is to have you feel like a burden was lifted from your shoulders, and that we made the whole process an easy one

If you're dealing with a legal matter, we urge you to schedule a free initial appointment today and join the many satisfied clients who have contacted Werner Law Firm.

23 Corporate Plaza Dr., Suite 150

Newport Beach, California 92660